An online payment gateway serves as a vital component in the realm of e-commerce and digital transactions. It acts as a virtual bridge to provide a safe and effective link between buyers and sellers, enabling safe financial transactions. Sensitive financial information can be transferred to the seller’s account from a customer’s bank account or credit card while maintaining confidentiality and privacy thanks to this technology. Its importance becomes particularly evident in enabling online purchases, overseeing subscription services, and handling donations, all of which contribute to a seamless and protected user experience. Furthermore, online payment gateways offer a multitude of payment alternatives, including bank transfers, digital wallets, and credit cards, which increases flexibility for both customers and enterprises. These gateways for online payment have developed into essential tools that are the cornerstone of the success of the digital economy due to the quick growth of online commerce.

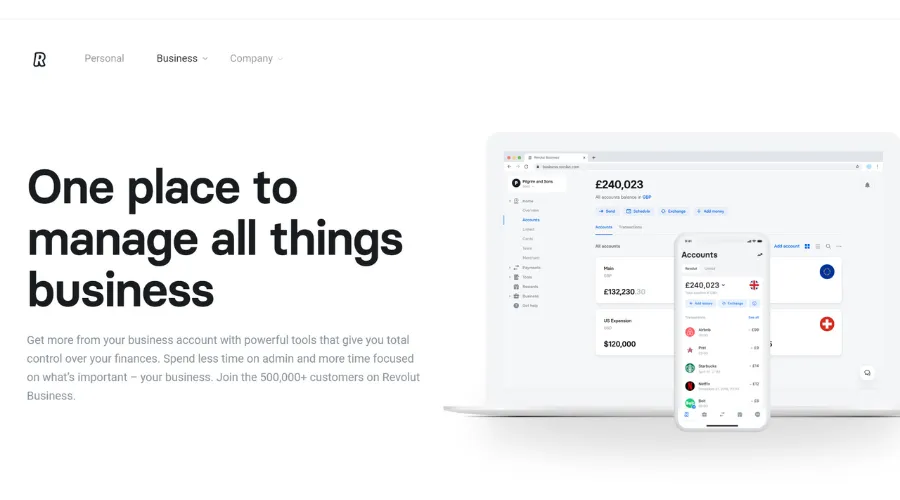

For businesses to succeed in the digital age, they need a strong online payment gateway in the always-changing world of commerce. One notable player in this domain is Revolut. This in-depth tutorial will examine the benefits and features of Revolut’s payment gateway, offer advice on how to set it up for your company, and explain the related costs.

Features of Revolut’s Payment Gateway

Revolut’s online payment gateway is packed with a wide array of features designed to enhance the online payment experience for businesses.

- Seamless Integration: The payment gateway provided by Revolut easily fits into your current e-commerce platform, making it simple to take payments online. Whether your business is a boutique online shop or a colossal enterprise, this integration is user-friendly and straightforward to employ.

- Multiple Payment Methods: When utilising Revolut, you have the flexibility to receive payments from various channels, encompassing credit and debit cards, bank transfers, and popular digital wallets such as Apple Pay and Google Pay. This adaptability guarantees that you serve a diverse clientele.

- Global Reach: Revolut’s payment gateway allows you to tap into a global customer base. It supports multiple currencies, making international transactions smooth and cost-effective.

- Enhanced Security: Online payments must always be secure, and Revolut’s payment gateway has excellent security features. It offers fraud prevention techniques and encryption to shield your company and clients from possible dangers.

- Real-time Reporting: Real-time reporting helps you stay up to date on the financial health of your company. Track sales, monitor transaction data, and gain insights into customer behaviour through the intuitive dashboard.

- Subscriptions: Revolut’s payment gateway also supports subscription-based models, allowing businesses to set up and manage recurring payments seamlessly.

Benefits of Revolut’s Payment Gateway

- Improved Customer Experience: With multiple payment options and global accessibility, you’ll provide a hassle-free and convenient experience for your customers, increasing customer satisfaction and loyalty.

- Increased Sales: A smooth, secure payment process encourages customers to complete their purchases. Revolut’s payment gateway can help reduce cart abandonment rates, ultimately boosting your sales.

- Cost-Efficiency: You can save money on foreign transactions and currency conversion with our competitive fees and multi-currency support.

- Data Insights: You can spot patterns, optimise your online store, and make well-informed business decisions with the help of real-time data and reporting tools.

- Security: Revolut’s strong security measures provide you and your clients peace of mind. The trust instilled by secure transactions can result in increased business.

Also Read: Revolut Card Payments Online: Revolutionising Digital Transactions

How Do I Set up Revolut’s Payment Gateway for My Business?

Setting up Revolut’s online payment gateway for your business is a straightforward process.

- Sign Up: First, visit the official Revolut website and sign up for a business account. You can log in if you already have a business Revolut account.

- Select the Payment Gateway: After logging in, navigate to the payment gateway section and choose the specific gateway type you wish to establish.

- Integrate with Your E-commerce Platform: Follow the on-screen instructions to link the payment gateway with your e-commerce platform. Revolut provides comprehensive support and documentation for popular systems like Magento, WooCommerce, and Shopify.

- Configure Payment Methods: Personalise your payment options, including the cards you take and any other payment methods you might like to provide.

- Set Up Subscriptions (if applicable): In the event that your company uses subscription-based business models, set up the payment gateway’s subscription settings.

- Test Transactions: Before going live, perform test transactions to ensure that everything is working as expected. This step is crucial to avoid potential issues when actual customers make payments.

- Go Live: Once you’re confident that your payment gateway is functioning correctly, switch it to “live” mode and start accepting payments from your customers.

What Are the Fees Associated with Revolut’s Payment Gateway?

For businesses keen on managing their finances and optimising their online payment solutions, Revolut’s Online Payment Gateway offers a transparent fee structure designed to help you keep more of what you earn. The pricing details, as available on their official accept payments page, underline this commitment to clarity. When you opt for Revolut, there are no initial setup costs; instead, you’re solely billed on a per-transaction basis. The transaction fees commence at an impressively low rate of 0.8%, with an additional £0.02. This pricing structure delivers adaptability, as you’re charged in accordance with the actual volume of transactions you conduct. It perfectly aligns with your business’s financial objectives, eliminating the need for prolonged commitments.

These competitive transaction rates present a substantial advantage, whether you operate a small online store or a large enterprise, allowing you to maximise your earnings while ensuring your customers enjoy a first-rate payment experience. Utilising Revolut’s Payment Gateway can significantly boost your business’s profitability and financial efficiency within the ever-changing landscape of e-commerce.

Conclusion

Revolut’s online payment gateway is a powerful tool that can significantly enhance your online business operations. Thanks to its wide range of features, numerous advantages, and competitive pricing, Revolut’s payment gateway is a valuable option suitable for businesses of any scale. The setup process is uncomplicated, and its security measures guarantee the safety of both your business and your customers during online transactions. Whether you’re aiming to extend your global reach, boost sales, or enhance the overall online shopping experience, Revolut’s payment gateway proves to be a valuable asset in the continually evolving landscape of e-commerce. For more information, visit Findwyse.