The way we perform financial transactions has changed dramatically in the era of digitisation. More practical and effective alternatives, such as card payments online, are displacing cash and checks as a means of payment. Of all the choices out there, the Revolut card has come to light as a ground-breaking alternative that is revolutionising the way we see online payments. This comprehensive tutorial tries to examine the many benefits and features of using the Revolut card for online purchases, providing explanations for why it is so much better than other payment options.

Vast Revolut ecosystem: Beyond a simple card

Prior to exploring the nuances of using the Revolut card for online payments, it is essential to comprehend the wider range of services that Revolut provides. Revolut was first introduced as a disruptive alternative to traditional banking, but it has now grown to provide a broad range of financial services, including business accounts, cryptocurrency investments, and stock trading. The core of this vast ecosystem is the Revolut card, which is renowned for its multi-currency support and real-time transaction monitoring.

Structure of Revolut cards for online transactions

Wallets with multiple currencies

The Revolut card’s capacity to store several currencies in distinct wallets under a single account is one of its most alluring features. Those who often use their cards to make online purchases from foreign merchants may find this very helpful. To make sure you always have the correct currency for your transaction and to prevent any currency conversion costs, you may quickly switch between currencies inside the app.

Notifications in real time

Real-time transaction alerts are a major benefit of using the Revolut card for online purchases. You get an immediate notice on your smartphone each time you finish a transaction. This real-time monitoring improves the security of your online transactions by helping you monitor your spending closely and acting as an instant alarm system for any illegal or suspect behaviour.

Advanced security procedures

Security is a top priority in the digital era, particularly with regard to online transactions. Revolut card has many cutting-edge security mechanisms to solve this issue. From the palm of your hand, you may activate or deactivate location-based security, freeze and unfreeze your card, and control services including contactless payments, ATM withdrawals, and internet transactions.

Virtual cards

Revolut provides virtual cards as a solution for customers who are very worried about the security of their card payments online. These are digital cards that are only meant to be used online that you may make using the app. Adding an additional degree of protection to online transactions, these virtual cards are completely revocable at any moment.

Special benefits of online payments with Revolut

Streamlined expense administration

The difficulty of keeping track of every transaction is among the most intimidating parts of using numerous credit cards while making purchases online. By providing real-time spending monitoring and classification inside the app, the Revolut card streamlines this process. To properly manage your funds, you may establish spending restrictions, make savings vaults in many currencies, and even schedule periodic transfers.

Total openness

The hidden costs associated with traditional cards and overseas transaction services are well-known. Transaction costs, foreign currency fees, and even inactivity fees are a few examples of them. All of these are removed by the Revolut card, which provides an open price structure that enables you to handle your online payments without unpleasant surprises.

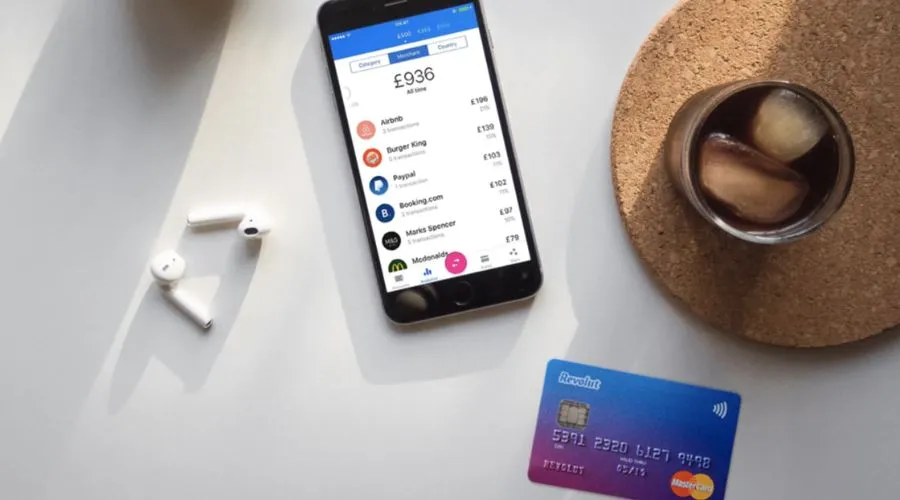

Detailed budgeting and analytics

You can get a detailed breakdown of your spending by categories, retailers, and nations using the Revolut app. Those who must carefully monitor their finances may find this option very helpful. To properly manage your funds, you may establish spending restrictions, make savings vaults in many currencies, and even schedule periodic transfers.

How Revolut is superior to conventional card payments online

Smooth user interface

Conventional cards often need more user interfaces, more app features, and better customer service. In contrast, the Revolut app is made with the user in mind. It’s a better option for contemporary consumers because of its feature-rich environment, simple design, and round-the-clock customer service.

Unbeatable economy

The Revolut card is an exceptionally affordable option for making payments online since it has no additional costs and offers real-time currency rates. Digital nomads, regular internet shoppers, and anybody else trying to get the most out of their online transactions may find this to be very helpful.

Unmatched control and flexibility

Revolut offers a degree of flexibility that is sometimes absent from conventional cards, making it ideal for today’s users. The Revolut app offers you total control over your online payments, allowing you to quickly switch between currencies, set up scheduled payments for regular costs, and even freeze your card in the event that it is lost or stolen.

Conclusion

Revolut’s wide variety of services has already caused ripples in the banking sector. It is now poised to completely transform the way we handle our online transactions with its emphasis on transforming online payments. It’s a complete financial solution designed to handle the particular difficulties of online purchases, not simply another card. It’s time for you to join this exciting revolution in online payments since the future of online payments with the Revolut card is here. For more information about taking card payments online, visit the official website of Findwyse.