Revolut, a prominent fintech enterprise, has positioned itself as a significant participant in this transformative trend through the provision of a comprehensive range of services that directly rival those offered by conventional banking institutions. The Revolut Savings Account stands out as a prominent feature offered by the company. Findwyse brings you all there is to know about this savings account so that you can take a informed decision.

Revolut Savings Account Types and Interests

Revolut offers a variety of savings account types to cater to different customer preferences and financial goals:

Standard Savings Account:

- The Standard Savings Account is the most basic option and is available to all Revolut users.

- This financial product provides a convenient method for individuals to accumulate savings while benefiting from a competitive interest rate.

- Individuals have the option to establish regular payments in order to automate their savings, facilitating the gradual accumulation of wealth.

Junior Savings Account:

Revolut offers a dedicated savings account for parents who want to save money for their children. This account allows parents to create a separate savings pot for their child’s future, fostering financial responsibility from an early age.

The interest rates on Junior Savings Accounts are usually attractive, providing parents with a way to maximize the growth of their child’s savings.

Vault Savings Account:

This is specifically tailored to cater to individuals who aspire to accumulate funds for targeted financial objectives, such as a vacation, acquisition of a new technology, or doing a home repair endeavor.

Individuals have the ability to generate personalized savings “vaults” and distribute monies to each one, aiding in the maintenance of organization and concentration on their financial goals.

Interest rates for Vault Savings Accounts can vary, often depending on the amount saved and the duration.

Group Savings Account:

This particular account is well-suited for collectives of acquaintances, relatives, or coworkers who desire to pool their resources for the purpose of collectively saving towards a shared objective, such as a group excursion or a joint present.

Users can invite others to contribute to the savings goal, creating a collaborative and engaging savings experience. Interest rates for Group Savings Accounts are often competitive, making it more rewarding for all participants.

Also Read: The Revolut Business Debit Cards: A Comprehensive Guide for Modern Businesses

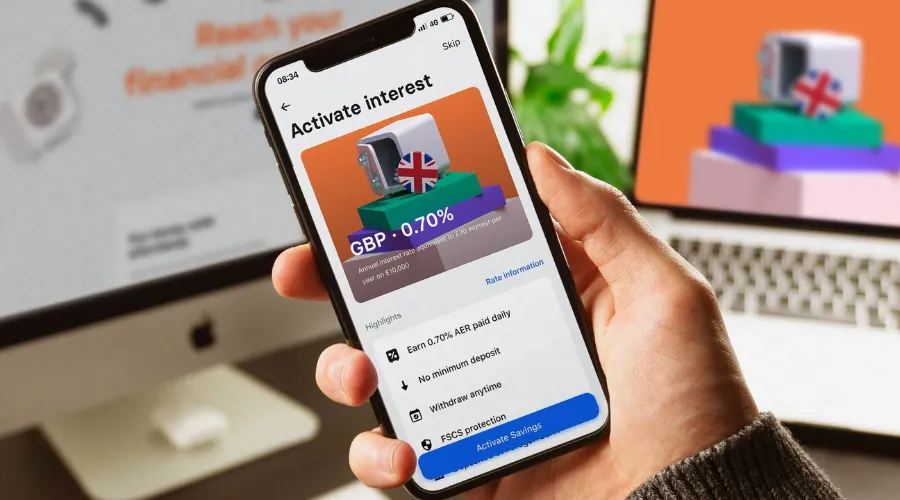

Interest Rates on Revolut Savings Accounts

Revolut Savings Accounts offer competitive interest rates that make saving more rewarding and help users grow their wealth over time. The interest rates can vary based on several factors:

Savings Balance:

Revolut often offers tiered interest rates, rewarding users with a better rate when they save larger amounts.

Savings Duration:

Some savings accounts may offer better rates for longer savings durations. Users who commit to saving for a specific period may receive higher interest rates.

Promotions and Special Offers:

Revolut occasionally runs promotions and special offers with higher interest rates for a limited time. These can be an excellent opportunity for users to boost their savings.

Features of Revolut savings Account

I. Flexible Saving Options

Revolut offers flexibility in how users can save money. Users can create different savings “pockets” within their accounts to save for specific goals or purposes, such as a vacation, a new gadget, or a rainy-day fund. This feature allows users to track their savings progress effectively and allocate funds for different objectives.

II. Round-Up Feature

One unique feature of Revolut’s savings account is the “Round-Up” feature. With Round-Up, users can link their debit or credit cards to their Revolut account. The app automatically rounds up each purchase to the nearest whole number and transfers the spare change to the savings account. This makes saving effortless and automatic, helping users accumulate savings without even thinking about it.

III. Currency Diversification

Revolut is known for its international presence, and its savings account allows users to save in multiple currencies. This feature is particularly advantageous for those who frequently travel or deal with foreign currencies, as it helps them mitigate currency exchange fees and fluctuations.

IV. Easy Withdrawals

While savings accounts are designed to encourage saving, Revolut understands that unexpected expenses can arise. Therefore, users can easily access their savings and make withdrawals whenever they need to without incurring penalties or extra charges. This flexibility is a notable feature of the Revolut savings account.

V. Security Measures

Revolut places a strong emphasis on security to protect its users’ financial information. The company employs robust encryption techniques and multi-factor authentication to ensure that users’ savings are kept safe from unauthorized access.

Conclusion

The savings account provided by Revolut presents a variety of characteristics that render it an appealing choice for individuals seeking to accumulate and increase their financial resources. The account offers attractive interest rates, a range of flexible saving options, and a distinctive Round-Up feature, offering customers novel avenues to achieve their financial objectives. Furthermore, the integration of mobile applications and the implementation of robust security measures contribute to the attractiveness of the Revolut savings account within the contemporary financial environment. For more information visit the official website of Findwyse.