In the modern global economy, foreign exchange (FX) is essential because it enables people and companies to swap currencies at favorable rates. Revolut is a quickly expanding FinTech firm that provides a variety of foreign exchange services, including FX forward contracts, via its website. We’ll explore the world of FX forward contracts in this article, as well as how Revolut helps consumers use these contracts to control their currency risk.

Rate of Exchange Forward

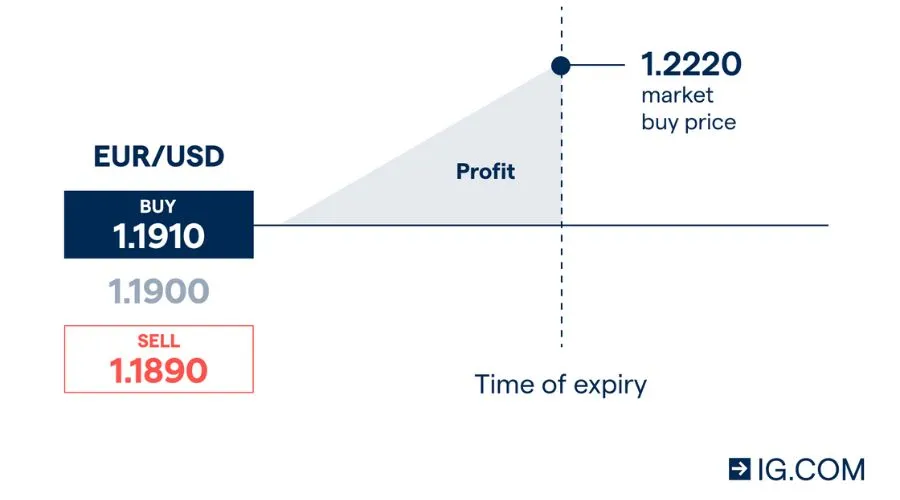

One of the most important ideas in the field of foreign exchange is the forward exchange rate. It describes the exchange rate at which two parties decide to swap money at a given future date. Forward rates offer a safe way to lock in a future exchange rate, which may be especially helpful for people and organizations exposed to currency risk. Spot rates, on the other hand, are for transactions that take place immediately.

Revolut Currency Conversion Services

A user-friendly site, Revolut, provides its consumers with a range of foreign exchange services. It offers a wide range of goods and solutions, and FX futures are becoming more and more well-liked because of their potential advantages in controlling currency risk.

How FX Forwards Work on Revolut

FX forwards on Revolut are designed to provide users with the ability to manage currency risk by securing a future exchange rate. Here’s how it works:

Fixed currency Rate:

The ability to lock in a fixed currency rate for a future date is the main benefit of utilizing FX forwards. This removes the uncertainty brought on by volatile currency markets.

Hedging Currency Risk:

Foreign exchange futures are a common tool used by businesses to protect themselves against currency risk. They may more efficiently manage their budget and safeguard their earnings from unfavorable currency fluctuations by getting a fixed exchange rate.

Speculation:

Certain users may utilize FX forwards for speculative purposes in an effort to get into advantageous contracts that will mature and profit from favorable currency fluctuations.

Flexibility:

Revolut provides flexibility by letting customers select the forward contract’s period and currency combination. Customers may customize their FX forwards to meet their unique demands thanks to this.

Benefits of FX Forwards on Revolut

Mitigation of Risk

When conducting business internationally, both people and corporations may have serious concerns about currency risk. Revolut users may hedge their holdings using FX futures, offering protection against unfavorable currency moves.

Fixed Expenses

Predictability is another benefit of FX futures for financial planning. Since they are aware of the precise exchange rate they would get at contract maturity, businesses are better able to predict expenses.

Personalization

Revolut’s FX futures are flexible enough to allow customers to customize contracts to meet their unique requirements, be it investment planning, debt servicing, or import/export activities.

Competitor Prices

For its foreign exchange forwards, Revolut provides competitive exchange rates that are frequently better than those found in the spot market. Users may save money as a result of this.

Objectivity

Revolut is renowned for its exchange rate and charge transparency, which guarantees that customers are aware of the conditions and expenses related to their foreign exchange forward contracts.

Also Read – Revolut Multi Currency Account: A Global Financial Revolution

Conclusion

In a world where international commerce and investment are more intertwined than ever, foreign exchange forwards (forwards) are effective tools for controlling currency risk. Revolut provides an easy-to-use platform for both people and companies to access and take advantage of these contracts. The platform is a desirable option for those wishing to safeguard their financial prospects in the volatile foreign currency market due to its transparent, flexible, and cheap rates. For more information about FX forward and currency forward visit the official website of Findwyse.