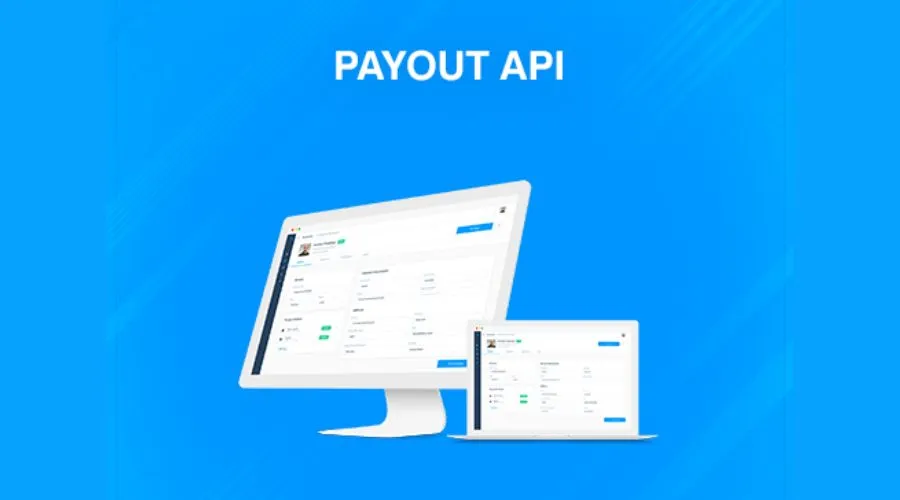

Application Programming Interface (API) integration is becoming a key component of innovation in the quickly changing financial world of today. Revolut is a well-known participant in the market; it is a financial technology and digital banking provider with a broad variety of services. The Revolut API payout is one of these services that has drawn a lot of interest.

Understanding Payment API Payouts

Payment APIs: A Fundamental Concept

Payment APIs, also known as Payment Application Programming Interfaces, are instruments that permit smooth communication for the purpose of facilitating payment transfers between financial institutions and other organizations, including enterprises. They offer the technological backbone for a number of financial services, including handling accounts, transferring money back and forth, and retrieving transaction histories.

The Importance of API Payouts

API payments are essential to contemporary financial ecosystems because they let companies automate financial transactions, cutting down on manual labor and boosting productivity. Realizing this, Revolut provides its API payout to developers and companies to make payouts easier.

The Revolut API payout

A specialized API created to make payouts to Revolut accounts easier to handle is the Revolut payout. It is an essential part for companies and developers that want to distribute money in a safe, economical, and effective manner. Revolut services may be integrated into other platforms or apps thanks to this API.

A specialized API created to make payouts to Revolut accounts easier to handle is the Revolut payout. It is an essential part for companies and developers that want to distribute money in a safe, economical, and effective manner. Revolut services may be integrated into other platforms or apps thanks to this API.

Important Revolut API payout Features

Harmonious Coordination

It is simple to connect the Revolut API payout to a variety of applications. This guarantees that companies may save time and effort by smoothly integrating Revolut’s payout services into their current systems.

Safe and Adherent

Compliance and security are critical in the financial sector. The security of financial transactions is guaranteed by Revolut’s API payout, which complies with all applicable rules and stringent security requirements.

Multi-Currency Assistance

Support for different currencies is one of the Revolut API payout’s noteworthy features. This lessens the hassles involved in currency translation and enables companies to easily make cross-border payouts.

Current Updates

Businesses may monitor the progress of their payouts with the help of the Revolut API payout, which offers real-time updates that guarantee accountability and transparency.

Benefits of Using Revolut API Payout

Price-Performance

Because Revolut’s API payout offers cheaper exchange rates and lower costs than traditional banking methods, using it may save businesses a lot of money.

Haste and Effectiveness

Traditional bank transfers can be difficult and time-consuming, especially when dealing with foreign currencies. Payouts are performed quickly thanks to the significantly quicker and more effective Revolut API payout.

Improved Experience for Users

Businesses may improve user happiness by offering their consumers a smooth and convenient payout experience by incorporating the Revolut API payout into their systems.

Simplified Processes

Revolut API payout-enabled payout automation simplifies company operations by eliminating manual labor and minimizing mistakes.

Use Cases for Revolut API Payout

Online Retail Platforms

Revolut API payout enables e-commerce companies to pay vendors, affiliates, and sellers, streamlining the payment process and boosting operational effectiveness.

Gig Economy Websites

The Revolut API payout may help businesses in the gig economy, such as ride-sharing services and freelancing marketplaces, by enabling them to pay their employees or service providers quickly and securely.

Cross-Trade Companies

Companies with global operations may make use of the Revolut API payout’s multi-currency functionality to streamline cross-border payouts and lower currency translation expenses.

Implementing Revolut API payout on Revolut

Documentation for APIs

On their website, Revolut offers thorough API documentation that includes step-by-step instructions on how to use the API payout. This documentation may be accessed by developers and organizations to comprehend the endpoints, request and response formats, and authentication mechanisms of the API.

API Code

An API key is required for developers and companies to use the Revolut API payout on Revolut. To make sure that only authorized users can use the API, this key is used for permission and authentication.

Challenges and Considerations

Observance

Although the Revolut API payout has many benefits, companies must make sure they abide by all applicable laws and guidelines to prevent legal problems and possible fines.

Protection

Preventing fraud and data breaches requires maintaining the security of the API key and the data transferred via the API.

Prices

Businesses should be mindful of the charges related to API usage and currency rate conversions even if the Revolut API payout can lower payout costs when compared to more conventional ways.

Conclusion

To sum up, the Revolut payment API is an effective tool that streamlines the payment procedure for Revolut accounts. Numerous advantages are provided by it, including speed, cost-effectiveness, and support for several currencies. This API is easy for developers and businesses to include in their systems, improving user experience and optimizing workflow. For more information visit the official website of Findwyse.